The Facts About Best Broker For Forex Trading Uncovered

The Facts About Best Broker For Forex Trading Uncovered

Blog Article

Everything about Best Broker For Forex Trading

Table of ContentsNot known Details About Best Broker For Forex Trading Not known Incorrect Statements About Best Broker For Forex Trading The 2-Minute Rule for Best Broker For Forex TradingSee This Report on Best Broker For Forex TradingThe Best Guide To Best Broker For Forex Trading

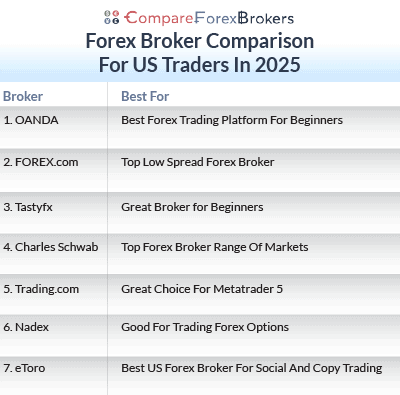

You ought to take into consideration whether you can afford to take the high threat of losing your cash. In recap, it is hoped that you now have actually the required expertise to discover an on-line forex broker that satisfies your demands. Whether it is policy, trading charges, deposits and withdrawals, client support, trading devices, or the spread you now know what to look out for when selecting a new system.Nonetheless, if you do not have the moment to study platforms on your own, it could be worth checking out the leading 5 advised foreign exchange brokers that we have talked about above. Each foreign exchange broker excels in a particular division, such as low costs, mobile trading, user-friendliness, or trust. Inevitably, just see to it that you comprehend the threats of trading foreign exchange online.

This implies that major forex sets are topped to utilize degrees of 30:1, and minors/exotics at 20:1. However, if you are an expert trader, these restrictions can go right approximately 500:1 on majors. While minimum deposits will certainly differ from broker-to-broker, this usually averages 100 in the UK. If the broker is based in the UK, after that it should be controlled by the FCA.

With such a large market, there will certainly be always a person going to acquire or market any kind of currency at the priced estimate cost, making it easy to open and shut trades or transactions at any type of time of the day. There are periods of high volatility during which it could be not easy to obtain an excellent fill.

Best Broker For Forex Trading Things To Know Before You Get This

Yet as any type of various other market, throughout periods of instability slippage is constantly an opportunity. Greater liquidity additionally makes it tough to control the marketplace in an extensive manner. If some of its participants try to adjust it, the individuals would certainly call for enormous quantities of cash (10s of billions) making it almost difficult.

We will speak about this later. The Forex market is an around the clock market. Best Broker For Forex Trading. This means that you might open or close any placement at any type of time from Sunday 5:00 pm EST (Eastern Requirement Time) when New Zealand begins procedures to Friday 5:00 pm EST, when San Francisco terminates procedures

Some brokers provide up to 400:1 take advantage of, suggesting that you can control for circumstances a 100,000 United States dollar deal with just.25% or US$ 250. This also enables us to maintain our working capital at the minimum. Beware as this is a double-edged sword. If the take advantage of is not properly made use of, this can likewise be a downside.

We will go deeper in to this in the following lesson Therefore, utilizing utilize higher than 50:1 is not suggested. Keep in mind: the margin is made use of as a down payment; whatever else is likewise at danger. The Forex market is taken into consideration one of the markets with the most affordable expenses of trading.

The Only Guide to Best Broker For Forex Trading

There are 2 essential gamers you can not bypass in the forex (FX) market, the liquidity suppliers and brokers. These parties' partnership makes sure a liquid and effective FX market for investors. check Liquidity providers make sure that the marketplace has tradable money sets and provide pricing details. While brokers link traders to liquidity carriers and execute professions in support of the investors.

Brokers are individuals or companies who represent traders to purchase and market properties. Assume of them as middlemans, assisting in deals in between investors and LPs. Without them, traders would encounter difficulty with transactions and the smooth circulation of profession. Every broker needs to acquire a license. They are regulated by economic governing bodies, there more than 100 regulatory bodies globally, these bodies have differing levels of emphasis and authority.

Little Known Questions About Best Broker For Forex Trading.

After the parties concur, the broker his explanation forwards the LP's offer to the trader. When the cost and terms are acceptable, the trade is performed, and the possession is moved. To sum up the cooperative dancing, each event take their share of the gained charge. Online brokers charge the investor a commission while LPs make revenues when look these up they purchase or sell properties at rewarding costs.

Digital Interaction Networks (ECNs) attach traders to numerous LPs, they offer competitive prices and clear execution. Right here the broker itself acts as the LP, in this version, the broker takes the opposite side of the profession.

When both celebrations get on the exact same web page, the connection in between the two is usually helpful. A collaboration with LPs makes it easier for brokers to fulfil different trade proposals, generating even more clients and boosting their company. When online brokers access multiple LPs, they can provide competitive costs to investors which boosts increased customer complete satisfaction and loyalty.

Some Known Questions About Best Broker For Forex Trading.

Allow's study the key areas where this cooperation beams. This collaboration aids to increase the broker's resources base and allows them to provide bigger trade sizes and satisfy institutional clients with substantial investment demands. It likewise broadens LPs' reach with confirmed broker networks, thus giving the LPs access to a broader puddle of potential customers.

Report this page